Check your status now to map obligations; deadlines follow from this. For earnings linked to the region, including rental proceeds, assemble documents and consult the internet to map the báza rules, currency specifics, and the efektívne operations of filings.

Pre. nerezidenti with earnings sourced inside the federation, the relation medzi báza obligations and related charges is guided by an schválené framework; earnings include salaries, rental proceeds, marketing revenue; to keep operations efficient, consult the internet pre najnovšie zoznam of requirements and thresholds.

Begin with the zoznam of steps available online; this internet portal supports filings; the báza rules are published by the federácia; currency conversions follow the schválené rate; in the Moskva hub, on-site advisers aid interpretation of region-specific requirements; apply this základňa to calculations to ensure correct amounts.

In practice, maintain records for rental proceeds; salaries; other earnings; the region may require separate filings for multiple origins; deadlines must be met; non-compliance triggers penalties; progress tracking via the internet keeps you on schedule; this approach supports efektívne operations.

Maintain a steady pace, monitor progression of obligations across the federation; the Moskva hub serves as a practical resource; the zoznam of tasks, currency considerations, rental scenarios form the báza for compliance progress.

Russian Tax Residents: Practical Guide to Personal Income Tax

Keep the agreement on file, ensure recording of earnings this year, and complete payment within days set by authorities to reduce the possibility of a failure in processed records.

This base determines the amount payable by russian nationals and others; additions such as depreciation, bonuses, and allocations to beneficiaries may adjust the calculation. The rule establishes the framework for how the calculation is performed and which components are included.

Register with the authorities and submit the forms on time; ensure these documents are processed in a well-timed manner within the days following year-end to avoid penalties.

Independently audit the records, verify the numbers themselves, and prepare for any review. This well planned approach reduces the possibility of errors and supports timely adjustments.

In practice, старший специалист explains the well-defined framework and express the requirements clearly, clarifying which forms to use and how to register additions to the base; individuals themselves can verify compliance.

Avoidance measures should be documented; they express the standards clearly to ensure consistency. If exceeding thresholds occurs, follow prescribed steps to adjust and refile records.

Determining Tax Residency: 183-Day Rule and How to Count Days

Count days precisely using a day-by-day ledger; build data from documentary sources; keep current data in a master base; set up an e-mail notification for updates in april; zero days outside the federation do not count toward the threshold.

Apply the 183-day rule for the federation: total days present during a rolling 12-month window; any day spent inside counts toward the threshold; days spent outside are excluded unless linked to recognised activities or formal stays. In moscow, recognised practice remains consistent.

Arrival day counts; departure day counts; if you split a stay across borders within 12 months, treat segments as separate blocks while aggregating total.

Workflow to ensure accurate results: obtaining official data from databases; cross-checking with travel logs; relying on documentary evidence such as hotel receipts, boarding passes; maintain a supporting repository; use a service to reconcile records before april; keep the base up to date for negotiations with authorities.

Property ownership or trust arrangements may influence dwelling patterns; include documentary proof in the data pack.

Depreciation policies are accounting items; depreciation is unrelated to presence tally; ensure depreciation data are accounted within property records.

Employer withhold impacts payment records; verify the payment dates in payroll data; ensure paid periods align with presence; supporting successful compliance with current data flows; databases feed the service; systems team ensures quality, reliability.

Applications for relief require documentary materials; obtaining this data supports the case.

| Obdobie | Days | Presence | Dôkaz | Status |

|---|---|---|---|---|

| Rolling 12 months ending april 30, 2023 | 120 | inside federation | passport data; hotel receipts | above threshold |

| Rolling 12 months ending april 30, 2024 | 65 | inside federation | flight logs; e-mail records | below threshold |

What Counts as Taxable Income for Residents: Salaries, Bonuses, and Other Earnings

Start with listing the primary earnings categories; determine treatment under treaty provisions; prepare the submission with accuracy.

Salaries, bonuses, commissions, tips; benefits in kind constitute core earnings; classify each item to decide base remuneration treatment; refer to treaty provisions to identify applicable exemptions or reductions; use the return template to reflect these determinations.

Other earnings include stock-based rewards; severance pay; profit-sharing; allowances; reimbursements; non-cash benefits form additional earning streams.

Consult the informational website data published by the center to confirm inclusions; privacy rules govern data collection for individual earnings; those who must file must register before the time limit; ensure no incomplete submissions; para data fields contain amounts paid, amounts received, dates recorded.

In cases touching property interests, cadastral data may adjust the base; internal filings reviewed by the директоруправляющий role within the center determine final assessed amounts; time of obtaining receipts affects timing of recognition.

Non-profit structures may have distinct treatments; base data on collected records must be accurate; ensure items are accounted; prepare to register details timely; the return requires a complete list of items, with amounts disclosed per line item; privacy policy addresses data retention, submission completeness.

Cross-check with external sources: employer payroll, contracts; cadastral records where relevant; obtaining supporting documents accelerates review; use the center’s checklist to avoid incomplete submissions; keep privacy compliant trail.

Deadlines and Filing: When and How to Submit Your PIT Return

Submit remotely through the official portal by the stated date; online filing preferred; a confirmation receipt appears in the account; privacy controls protect data. For paper submissions, deliver to the local office prior to the deadline; include all attachments; keep copies for records.

- Gather required materials: identification details, receipts, revenue summaries, currency data; ensure accuracy; verify totals against ledgers.

- Register on the portal, create an account; complete identity verification; link any necessary documents.

- Fill the PIT form on the web portal; attach supporting statements; review for errors; sign electronically; submit before the deadline.

- After submission, monitor the account for messages from the controlling authority; file corrections later if needed; confirmations appear in the portal.

Tips; notes:

- Remotely submit, minimizing trips to offices.

- Relatives listed as beneficiaries should be notified of any relevant information.

- All figures counted accurately; data must be accounted in the system.

- Third party entities may assist; verify authorization; clarify role.

- Users should register with full name as name field; keep privacy controls tight.

- What to do if suspension of submission occurs: consult юрист; court may handle disputes; судебные proceedings possible.

- In relating to or involving застройщиков, гражданское matters: track via internet portal; keep documentation in one file.

- Company-level documentation: include financial results; disclose currency conversions for foreign revenue.

- спорттивное deductions require appropriate receipts; other types of deductions eligible if supported.

- Appropriate currency conversions: use official exchange rates; record source of rate used.

- Юрист advice: liability exposure if misreporting; seek guidance on jurisdiction.

- Liability rests with the user; file accurately to reduce risk.

- Internet connection stability matters; save draft submissions; use auto-save features.

- Сделки with counterparties require attached contracts or invoices where applicable.

- Agents acting on your behalf: verify power of attorney; confirm scope of duties; avoid misrepresentation.

- Suspension of processing could occur for violations; resolve quickly.

- What to do later: check for corrections; renew credentials; update contact details.

- Name on the document must match official IDs; ensure spelling accuracy.

- Positive outcome from timely submission reduces liability.

- Social receipts or contributions appear in records; ensure sources documented.

Withholding, Prepayments, and Payment Options for the PIT

Recommendation: implement source withholding for salaries; bonuses; compensation; service payments; property lease charges; goods-related payments; configure calculation within the organisation’s payroll module; verify base; verify deductions against source documents; duty to remit rests with the employer; year-end reconciliation follows the established cycle; deadlines must be met by following the internal protocol; директоруправляющий must approve changes.

Withholding scope includes salaries; compensation; service payments; other remuneration; source data comprises payroll records; contract terms; property usage; advertising revenue; revenue from goods supply; processing occurs monthly; remittance channels include bank transfer; online portal; mobile wallet; deadlines for submission exist; the organisation must designate a responsible officer; kashaev notes this approach generally improves accuracy; tasks done on time.

Prepayments: part of the scheme for non-salary income source; quarterly installments; deadlines: the 15th day following each quarter; processing may adjust with year changes; channels for remittance remain the same; consent for data sharing with third parties if required.

Payment options: channels available include bank transfer; online portal; mobile wallet; cash at office; remittance coverage spans both electronic routes; processing steps: issue receipts; verify balance; store confirmation; deadlines tracked; consent required for data handling.

Compliance note: changed rules take effect after review by organisation leadership; директоруправляющий must approve changes; informational notices must be provided; source includes property; advertising; service income treated as base; qualified staff support accurate processing; deadlines monitored.

Non-Residents: Key Obligations, Common Pitfalls, and Penalties to Avoid

Know key deadlines for file submissions; prepare disclosures; ensure confidentiality; implement blocking measures for non-compliance; align actions with July reporting windows.

Based on legislation, non-residents must report proceeds from sources within the jurisdiction; document agreements; file statements for interests in ventures; disclose banks, clients; disclose counterparties; comply with procedures; keep сделки records; monitor operations in line with regulations; founders, trust structures, developers require explicit disclosure of interests; rely on a formal agreement trail.

Common pitfalls include late submissions; incomplete disclosures; misclassification of payments; reliance on informal cash channels; blocking banks; confidentiality gaps; insufficient documentation for сделки; missing or flawed agreements; failure to file timely; insufficient verification of procedures by external experts; weak governance across investor groups; rise of informal networks; risks of double reporting;

Penalties include fines; blocking of assets; restrictions on operations; interest charges; additional assessments for deliberate concealment; amended declarations required; higher rates for repeated violations; July enforcement cycles demand swift cooperation with authorities; example: an expert review of agreements; trust structures; founder interests demonstrate a practical path to compliance; the procedures include regular checks; confidentiality controls; accurate recording of proceeds; failure to comply triggers escalation.

Taxes due, based on proceeds, are calculated under legislation; timely filing reduces penalties; technologies used for reporting shorten cycles, while confidentiality remains a priority; being compliant stabilizes operations; example workflows from expert teams illustrate the path from file to confirmed results; rising risk of non-compliance triggers more stringent checks.

Daňoví rezidenti Ruskej federácie – povinnosť priznať a platiť daň z príjmu fyzických osôb">

Daňoví rezidenti Ruskej federácie – povinnosť priznať a platiť daň z príjmu fyzických osôb">

The Best 10 Weekend Getaways in Russia in 2025">

The Best 10 Weekend Getaways in Russia in 2025">

The Freezer as a Gateway to Russian Soul – A Culinary Exploration">

The Freezer as a Gateway to Russian Soul – A Culinary Exploration">

The Ultimate Russian Food Guide – 50 Must-Try Dishes">

The Ultimate Russian Food Guide – 50 Must-Try Dishes">

Where to Try Caviar Pelmeni, Borscht and Russian Specialties in Moscow">

Where to Try Caviar Pelmeni, Borscht and Russian Specialties in Moscow">

16 Best Moscow Breweries &">

16 Best Moscow Breweries &">

Russia Extends Electronic Visa Validity – Implications for Travelers">

Russia Extends Electronic Visa Validity – Implications for Travelers">

How to Make Authentic Milk Kefir at Home – A Step-by-Step Guide to Traditional Fermentation">

How to Make Authentic Milk Kefir at Home – A Step-by-Step Guide to Traditional Fermentation">

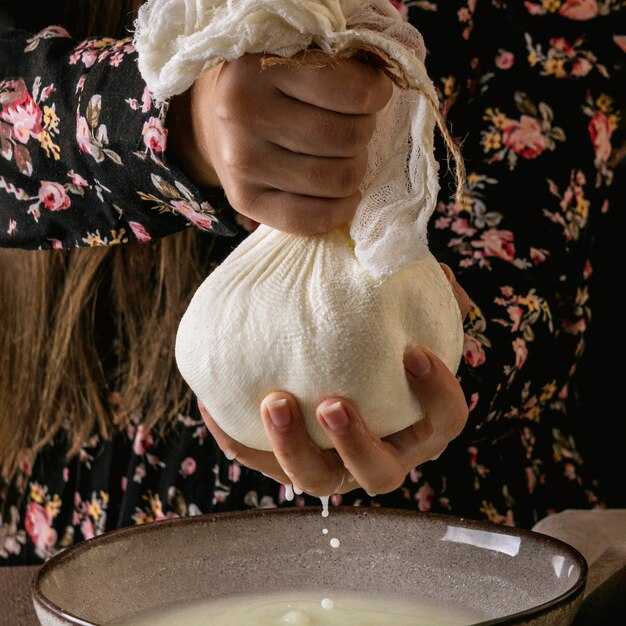

How to Make Authentic Russian Tvorog at Home – A Step-by-Step Guide">

How to Make Authentic Russian Tvorog at Home – A Step-by-Step Guide">

Residential Property in Russia – What You Should Know Before Buying">

Residential Property in Russia – What You Should Know Before Buying">

21 Trendy Restaurants in Moscow – Top Places for Foodies">

21 Trendy Restaurants in Moscow – Top Places for Foodies">